The true cost of claims

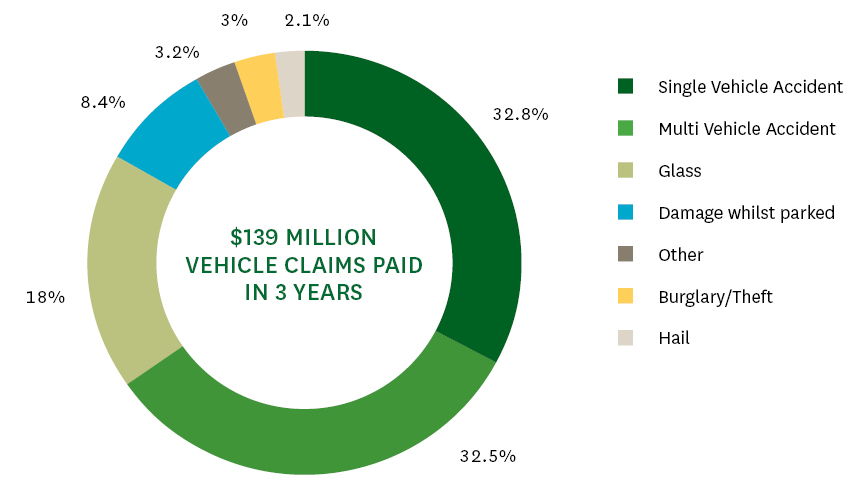

Over the past three years FMG has paid out almost $140 million in car, van, and ute claims. But that’s just a dollar figure. We know that your vehicle being out of action can have a huge effect on your day-to-day so where possible, we try and get you back on the road as quickly and safely as possible.

Distractions causing accidents

Most claims we pay are for vehicle accidents. These include single vehicle accidents (e.g. someone backing into a pole) and multi-vehicle (e.g. scraping the side of another car). We know that distractions, like using your mobile phone while driving, can play a role in accidents. Check out Waka Kotahi NZ Transport Agency's helpful tips to avoid driver distraction.

Making glass claims quickly

A small chip to your windscreen can turn into a much larger crack if you don’t get onto repairing it. Damage to vehicle glass (particularly windscreens) is the second most common vehicle claim we see. FMG clients with the right cover can use our quick claims process through our online service FMG Connect, and have their vehicle glass repaired within just a few days.

Burglary and theft

Our top three most paid claims types for cars, vans, and utes are related to accidents or damage, but we also paid over $4 million in burglary and theft claims over the last three years, too. There are plenty of things you can do to deter and prevent would-be thieves including installing a steering wheel lock, car alarm, and immobiliser. We have more advice on rural crime prevention here.